PlutusSwap Report

Find all of our updates and report here-

17th December 2020

Spend $yPLT anywhere, anytime

With PlutusSwap branded debit cards, you can!

Other than empowering financial inclusion for everyone, we envisioned building a platform that brings actual use cases to drive mass adoption of cryptocurrency. yPLT will be used in our expanded ecosystem and for real-life use cases such as with the PlutusSwap Debit Card. yPLT token holders will be able to load yPLT into the debit card for spending. This improves the liquidity of its coins. How the card work will be similar to a typical debit card, and will be accepted at various retailers with card payment options across the world. It will also be able to allow users to withdraw cryptocurrency as cash at supported ATMs.

UnionPay will be the chosen payment gateway. The UnionPay is accepted in 174 countries and regions worldwide and it owns the biggest market share in Asia while holding a strong position in other continents as well. As most merchants accept Unionpay, this means you can use the card to make payment for food to fashion to travel. This is truly a new era of cryptocurrency use case with the card as yPLT token holders will be able to load the debit card with their digital assets.

This integration will provide yPLT Token Holders with the much-needed crypto to fiat conversion so they can load their PlutusSwap Branded debit cards with USD via the online portal.

We are slated to kickstart pre-orders end in Q1 2021. Only yPLT token holders will be eligible to receive the cards.

We have contacted our card vendors for the debit cards and is working on the portal that allows users to deposit and track their yPLT spending.

Do note that KYC is required for debit card registration and it will come at a fee. Details on fees and registration process will be announced after the team has finalised details with card vendors. Fees will be paid in yPLT of course.

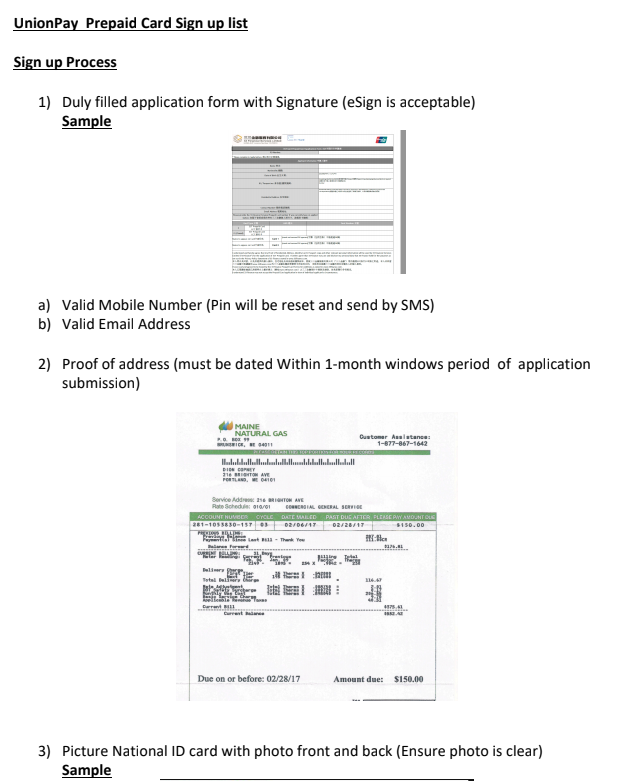

Example of KYC requirements:

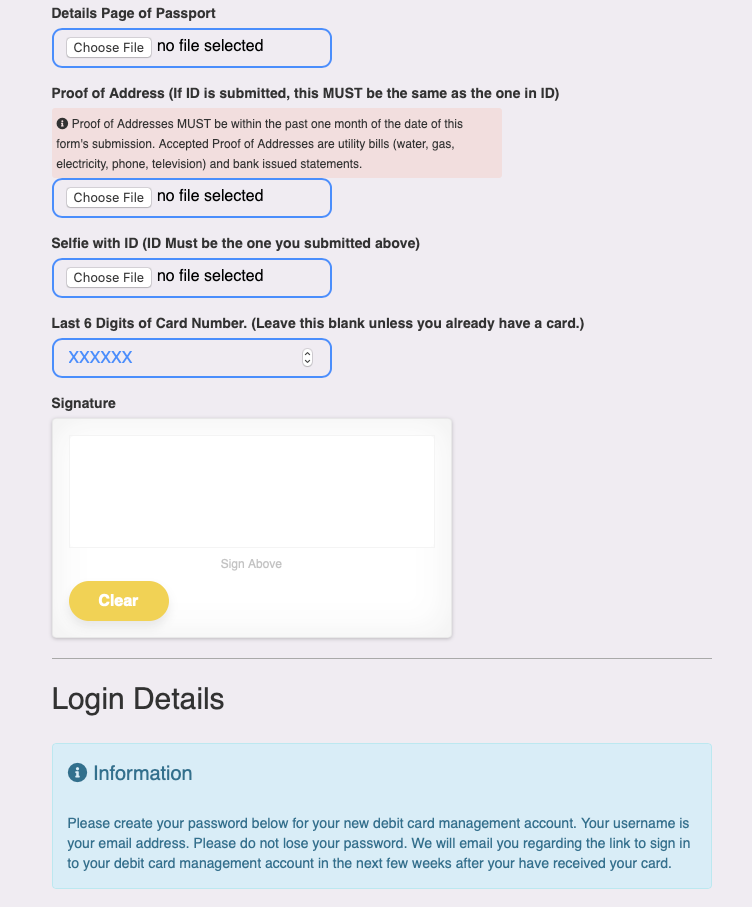

Debit Card portal registration page:

On the other hand, Plutus Capital is also working on Plutus Chain 2.0 that yPLT token holders will be able to leverage on. To find out more about existing Plutus Chain, please refer to these materials:PlutusCapital/plutusgithub.com

Who is behind yPLT? Since 2015, we have been a diverse group of pragmatic individuals and idealists. We believe that the key to unlocking economic equality, prosperity and financial freedom lies in developing strong Fintech use-cases on cutting-edge Distributed Ledger Technology. Most importantly, we are neither a chef nor food. We aspire to bank the unbanked, bringing fundamental financial rights to billions of individuals across the globe. We want to unbank the banked, stripping away the financial prison that many in the first world are enslaved to.

We are the followers of the great Plutus.

PlutusSwap Website Plutus Capital Twitter Discord Telegram Channel Telegram Group Github Master Contract

13th December 2020

Dear PlutusSwap Community,

As many of you are looking forward to PlutusSwap upcoming AMM launch, we are pleased to announced that the progress has been smooth and we will be conducting a internal audit before project release. And of course it's time for external audits as well!

This means that PlutusSwap platform will not just be a farming protocol anymore and we are one step closer to integration on Plutus Capital lending app!

Our upcoming AMM launch will allow users to not just stake LP tokens and earn yPLT rewards, but also allow users to trade and swap tokens while earning rewards!

yPLT will be the governance token for PlutusSwap, allowing token holders to vote on proposals. We will also be integrating PlutusSwap into the existing Plutus Capital infrastructures. Instead of just farming for yPLT by staking UniSwap LP tokens, our users can swap for different ERC20 tokens and provide liquidity into different pools directly on PlutusSwap as well. As a liquidity provider on PlutusSwap, you will receive our very own LP tokens and earn trading fees for swaps that occurred on PlutusSwap. On top of that, users can earn extra incentives by staking these LP tokens and farm yPLT.

Incentive model for AMM:

0.25% to LPs, 0.05% to yPLT holders

Meanwhile, farming on Plutusswap is still operational! You can still stake LP tokens and be incentived with yPLT. Farm while getting ready for AMM launch!

We thank all of our community members for their support over the past few months and we will continue to bring you the latest update and progress. Stay tuned for PlutusSwap 2.0!

Do note that we wil also be hiring external auditors before releasing PlutusSwap 2.0. Funds used for external audits will come from $yPLT generated from liquidity mining. Do let us know if you have any external auditors recommendation! The remaining yPLT will be reserved for future platform development and marketing campaigns for yPLT token holders.

With love,

PlutusSwap team

5th December 2020

yPLT Contribution to Initial liquidity For yPLT/EMOJI

In return for providing initial liquidity for yPLT, initial token depositors of these pools will receive 70% of the LP tokens. In other words, you will get back 70% of your yPLT AND 70% of EMOJIs! Do note that only a maximum of US$20,000 worth of DeFi tokens for initial liquidity will be accepted per pool, based on a first-come-first-served basis. There will be a minimum contribution of 30,000 yPLT per wallet for initial DeFi token liquidity contribution. Any voluntary deposits more than the maximum amount or less than the minimum contribution will be refunded.

All initial DeFi tokens to be deposited into- 0x8bf7e3E4016d8b6980dD0D14Ae179B26e720dEb5

We are excited for EMOJIS Farm launch, and we will be looking forward to our partnership. More info:

10th November 2020

EMOJIS Farm x PlutusSwap

Dear PlutusSwap community,

Following Plutus Capital’s PLT listing on Digifinex announcement, we are excited to update our community that our partnership with EMOJIS farm is confirmed and yPLT token holders will be incentivized to stake on our partner’s unique DeFi protocol. EMOJIS.farm is set to launch on 23th November and thereafter, you will be able to deposit either yPLT/EMOJI Uniswap LP tokens or just yPLT on EMOJIS Farm in order to earn LP tokens as an incentive for providing liquidity. This is the first step into our long term partnership and we will be working on future integrations between these two platforms!

Let’s take a look at what is EMOJIS farm and how it works-

EMOJIS Farm is a supplementary product and a complementary brand to the Consentium Ecosystem - a multi-feature chat application built on the blockchain. EMOJIS farm concept rides on several ideas in the Decentralised Finance space, particularly in the areas of yield incentivisation and liquidity pools.

EMOJI Farms provides added liquidity to PlutusSwap’s yPLT by tapping on users looking at additional yield farming opportunities. It does so by generating much more liquidity for yPLT.

To ensure that EMOJIS Farm does not create unsustainable yield incentivisation crisis, the APY for the yield pools will always be fixed at 1000% APY (or ~11x of LP token). In order to qualify for the 1000% APY, token holders need to serve as LP providers for the respective pools of their choice, and they can do this by adding liquidity by providing either EMOJI or yPLT token via the Half-Liquidity (HL) function or deposit their Uniswap LP directly. There will be a fee of 5% enacted on any withdrawal of LP tokens. This 5% will be redistributed back to the hands of users who continue to stake their LP tokens in the specific pool.

Assuming that you are participating in the yPLT/EMOJI. As aforementioned, your staked deposits will generate LP rewards. This initiates EMOJIS Farm smart contract, which will mint a certain amount of EMOJI and internally swaps them for yPLT. To rebalance the pool, EMOJI of equivalent value are minted by the smart contract and redeposited back into the pool to generate LP tokens as rewards that will be distributed amongst all users.

Users are awarded compounded interest via rebasing. The rebasing function is called once a day and it is during rebase where EMOJIS are minted automatically and funnelled through the Half-Liquidity (HL) function to EMOJI pools in order to generate LP tokens. The rebase function is executed by any transaction sent to the smart contract.

EMOJIS Farm is the brainchild of Consentium, an existing cryptocurrency project that has been around since 2018. They envision to be a crypto super app that allows users to communicate through individual or group chat, transfer and deposit cryptocurrencies, interact with C2C e-commerce features and reward users who stake CSM on their very own open-source wallet. Our partner launched their own mainnet this year and has successfully migrated from the Ethereum network to their proprietary blockchain, CSM Chain. They boost a community of 100,000+ users and has various blockchain partners with their ecosystem. Other than benefiting from higher liquidity for yPLT, this partnership allows the Plutus Capital/PlutusSwap ecosystem to ride on a high volume industry such as chat/e-commerce applications. With a lending and chat application partnership in place, we are very much looking forward to every possible integration between these two different industries!

https://twitter.com/EmojisFarm

6th November 2020

The biggest financial news in recent weeks is the IPO of Ant Group — it was to be the largest IPO in the history of all IPOs (until it was suspended on November 2, 2020).

The FinTech group is known for its Alipay mobile wallet app that handles payments. However, it aims to be a one-stop digital financial hub that also provides users access to investing, insurance services, and wealth managment with the use of financial technology and cloud services.

The expansion of financial technology services by the Ant Group is an indication of the growth and acceptance of FinTech worldwide.

Despite the growing global use of financial technology, there are questions of the security and privacy of personal data stored on cloud servers, as well as the transparency of transactions to prevent counterfeit or fraud.

What is FinTech

FinTech is the use of innovative technology to improve the delivery of financial services.

Current FinTech uses include the wireless transfer or remittance of funds, lending and borrowing of money without going through a financial intermediary, financial insurance products, and cryptocurrency investment and trading.

One good example of FinTech are lending apps, such as the Plutus lending app. It allows users to easily invest or borrow funds on its FinTech platform, and earn more competitive interest than traditional savings. In fact, just by depositing funds & keeping them on the app, users can earn 1% interest each month.

In some ways, FinTech aims to disrupt the current distribution and infrastructure models that traditional financial services operate on.

What is DeFi

FinTech transactions still require personal data such as telephone numbers and a password for setting up accounts. These personal information is stored on a cloud server, which is susceptible to hacks or other security breaches. One such example is the recent data breach faced by online retail platform, Lazada.

One way to manage these challenges is with Decentralised Finance, which is the opposite of centralised finance.

For the latter, a financial institution has the final say on how investments, trading, and loans are done. Many users have difficulties accessing financial services provided by traditional financial insitutions due to requirements such as high value collateral, loan limits, high loan interest rates, and border restrictions.

In DeFi, there are many apps running on blockchain technology. This distributes decisions among the users of the dApps, providing a peer-to-peer financial system. Users decide between themselves on financial matters such as what can be accepted as collateral and its value, how small or large a loan can be, loan interest rates and repayment periods, and more.

This peer-to-peer system enables more people access to financial services that they otherwise may not have access to.

The blockchain technology that dApps use help ensure that all transactions are immutable and transparent. This greatly reduces the incidence of fraud or counterfeit since transactions can be tracked to who made them, when they were made, and how much.

Blockchain technology also makes it harder to hack for user information or account access. Users need to provide a key to the people authorised to access their information or account. Only those with the correct key are able to view detailed information or process transactions.

A feature of DeFi is cryptocurrency, which is digital currency secured by cryptography. This makes the digital currency nearly impossible to counterfeit or double-spend.

As the volatility of the cryptocurrency is determined by demand and supply of peers, and are not affected by other economic factors that traditional currencies are susceptible to.

This allows more people to easily start trading in cryptocurrencies without the need of a huge initial capital, and they have total control over their investment decisions.

Working Hand in Hand

It can be seen that DeFi provides security to FinTech transactions, while bringing more financial control into the user’s hands.

Let’s take a look at PlutusSwap to explain this.

PlutusSwap is an upcoming revolutionary Automated Market Maker protocol built by the Plutus Capital community and powered by yPLT, which is its governance token.

Besides earning high yield on PlutusSwap, holders of yPLT can vote on proposals and decide on future development of the PlutusSwap ecosystem.

There are over 1500 Monthly Active Users (MAU) on the Plutus Capital Lending app, allowing users to lend, borrow and earn interest.

Plutus Capital will be implementing PlutusSwap AMM into our existing lending app, leveraging on the efficiency of an AMM system instead of using a traditional order book or arbitraging from the various exchanges in order for the lending function to work.

Harnessing on the power of DeFi with the integration of FinTech infrastructure and DeFi protocols!

Plutus Capital will be announcing an exciting update in upcoming days too. Stay tuned for the update!

26th October 2020

Dear PlutusSwap Community,

PlutusSwap: Unlocking Economic Equality, Prosperity and Financial Freedom for the Mass

With an end-goal of being a digital friction-free, open-sourced and equitable financial system, PlutusSwap is the enabler that is built on Plutus Capital’s vision of “Bank the Unbank, Unbank the Bank”.

Anthony Johnson, PlutusSwap Advisor and COO of VTransFair, shared with the community on how the Plutus ecosystem will revolutionise the Fintech and DeFi industry. In addition, Anthony also addressed questions from the community and gave a hint on an upcoming potential partnership in the near future.

Stay tuned for upcoming updates regarding partnership and product launch.

With love, PlutusSwap Team

20th October 2020

Dear PlutusSwap Community,

🪂Phase 1 of yPLT Airdrop Completed🪂

💰⛰️👩🌾👨🌾🧑🌾⛰️👨🌾🧑🌾⛰️👩🌾👨🌾⛰️💰

All qualified wallet addresses have been credited with the 1500 yPLT reward. We will commence another airdrop campaign with the remaining tokens. If you missed this, fret not! There will be another one upcoming 😉

If you did not receive the airdrop rewards and is very certain that you qualified, please send us your wallet address for confirmation. Thank you!

If you would like to download the PlutusSwap presentation slide from Block Live Asia webinar yesterday, we've shared the slides below.

With love, PlutusSwap

18th October 2020

Dear PlutusSwap Community,

Happy Sunday! And we are back at work 💪 As yPLT airdrop campaign is coming to an end, not all top 100 wallets qualified. Therefore, this is the suggested plan for distribution 🔽

Qualified yPLT token holders will receive their 1500 yPLT next week as promised. Remaining rewards not distributed will be reserved for another upcoming airdrop campaign, in align with upcoming developments and updates.

As a community-based project, we would love to hear your thoughts before moving forward with this decision! Let us know if you have any feedback and we will take that into consideration before an official announcement. Thank you and have a good week ahead ❤️

With Love, PlutusSwap Team

17th October 2020

Dear PlutusSwap Community,

We are pleased to update you that we will be going live this upcoming Monday on a webinar hosted by Block Live Asia, a blockchain event company. Join us to find out more about PlutusSwap from Anthony and ask all of the questions you have on Monday!

Forwarded from Block Live Asia - 💰Bank the Unbank, Unbank the Bank 🏦 Anthony from PlutusSwap will be sharing about how the Plutus ecosystem will revolutionise the FinTech and DeFi industry this coming Monday! Save your spot and register for "The DeFi Uprising" today!

With love, PlutusSwap Team

15th October 2020

Dear PlutusSwap Community,

💰PlutusSwap Update Completion💰

Only yPLT/ETH & yPLT/ETH LP tokens will be accepted on PlutusSwap farms.

10x Rewards will still be ongoing.

Liquidity Mining Emission Rate during Stage 1 = 10yPLT/Block

All set for upcoming DeFi partnership announcement and AMM launch!

We are also confirming details with a DeFi event company Block Live Asia regarding a webinar with the Plutus team! Stay tuned for updates.

If you still have LP on PlutusSwap, proceed to our master contract at

* Connect to your web3 wallet, and scroll down to "withdraw".

* Here are the pid numbers for each pool. Those in bold are removed pools.

pid: 0,

name: 'Tether',

symbol: 'USDT-ETH UNI-V2 LP',

tokenSymbol: 'USDT',

icon: '💵',

pid: 1,

name: 'USD Coin',

symbol: 'USDC-ETH UNI-V2 LP',

tokenSymbol: 'USDC',

icon: '🏦',

pid: 2,

name: 'Uniswap',

symbol: 'UNI-ETH UNI-V2 LP',

tokenSymbol: 'UNI',

icon: '🦄',

pid: 3,

name: 'Pickle',

symbol: 'PICKEL-ETH UNI-V2 LP',

tokenSymbol: 'PICKEL',

icon: '🥒',

pid: 5,

name: 'Ampleforth',

symbol: 'AMPL-ETH UNI-V2 LP',

tokenSymbol: 'AMPL',

icon: '🅰️',

pid: 6,

name: 'Chainlink',

symbol: 'LINK-ETH UNI-V2 LP',

tokenSymbol: 'LINK',

icon: '⛓',

pid: 7,

name: 'Plutus Party!',

symbol: 'YPLT-ETH UNI-V2 LP',

tokenSymbol: 'yPLT',

icon: '💰',

pid: 8,

name: 'Plutus Party!',

symbol: 'YPLT-USDT UNI-V2 LP',

tokenSymbol: 'yPLT',

icon: '💰',

pid: 9,

name: 'CORE Vault',

symbol: 'CORE-ETH UNI-V2 LP',

tokenSymbol: 'CORE',

icon: '☄️',

* Amount: Lp tokens balance x 10 power 18

Eg, if you have 2.75 LP tokens, enter -

2750000000000000000

*Hit "Withdraw"

Updated Etherscan/DEXTOOL Profile:

Thank you everyone for your support and we will update you as soon as we have new announcements.

Best Regards, PlutusSwap Team

14th October 2020

Dear PlutusSwap Community,

🔈 PlutusSwap Pools Update 🔈

To better incentivise $yPLT token holders, we will be removing other farms not related to yPLT LP. Thereafter, yPLT rewards generated through liquidity mining will be concentrated into 2 farms - yPLT/ETH & yPLT/USDT. Removal timing on 15th Oct TBA. Users on PlutusSwap who deposited other LP tokens will still be able to withdraw anytime after removal.

⏲ yPLT Emission Reduction ⏲

Genesis Mining started on Ethereum Block Height: 11009000

Stage 1 Mining will begin 50,000 blocks later at: 11059000

Ethereum Block Countdown:

With Love, PlutusSwap Team

13th October 2020

Revised Airdrop Campaign

Dear PlutusSwap community,

After a round of careful consideration, we've decided to revise the numbers from the announced airdrop campaign. We thank everyone (especially Mr ZeroSumGame on Telegram) for your constructive comments. Although the community suggested the team to reduce the top 300 wallets to top 50 wallets, we need to take fair distribution into consideration. To encourage overall growth, only the Top 100 wallets with min 5,000 yPLT will qualify for the 1,500 yPLT reward.

Revised details: 150,000 yPLT in DEV wallet will be distributed to the top 100 token holders (including existing token holders as shown on Etherscan *except UniSwap, PlutusSwap and Dev wallets). An equal amount of yPLT will be divided and distributed to the top 100 token holders. To qualify, each wallet must hold at least 5000 yPLT.

Snapshot will be taken at random timing from Wednesday to Sunday (14th Oct - 18th Oct, 22:00 GMT +8). Users must hold a min of 5,000 yPLT during this period starting from 14th Oct, Wed, in order to qualify. yPLT Rewards will be distributed the following week.

No submission of form or registration required on the user's end. Just need to have yPLT in wallet and user will receive the yPLT rewards the week after.

Each qualified users will receive 1500 yPLT as reward.

With Love, PlutusSwap Team

12th October 2020

yPLT Airdrop — Top 300 Wallet

Dev will distribute the 5% yPLT generated from liquidity mining back to the community.

Dear PlutusSwap community,

As part of our initial effort to rebuild the community before PlutusSwap AMM system launch, we will be distributing yPLT tokens in DEV wallet to our existing and new token holders.

150,000 yPLT in DEV wallet will be distributed to the top 300 token holders (including existing token holders shown on Etherscan *except UniSwap, PlutusSwap and Dev wallets). An equal amount of yPLT will be divided and distributed to the top 300 token holders. To qualify, each wallet must hold at least 500 yPLT.

The snapshot will take place on Sunday, 18th OCT 23:59 (GMT +8). yPLT Rewards will be distributed the following week.

No submission of form or registration required on the user's end. Just need to have yPLT in wallet and user will receive the yPLT rewards the week after.

Each qualified users will receive 500 yPLT as reward.

Why did the team distribute back the yPLT generated from liquidity mining?

We understand that our community members will be concerned about the yPLT emission rate during genesis mining. 5% of the yPLT mined during the genesis stage means that the PlutusSwap Dev is currently one of the top few token holders of yPLT. To prevent future #FUD of Dev dumping yPLT, we decided to give back majority of the yPLT and further emphasise on equitable distribution during the initial stage. Development for PlutusSwap will still continue with funding from Plutus Capital’s existing resources.

What is the purpose of this airdrop campaign?

On top of distributing yPLT to existing token holders, our goal here is to encourage new community members into our ecosystem before AMM launch. Targeted 300 token holders is just a start and we don’t intend to stop there. You can continue to stake the LP tokens and receive yPLT in return. As for what can you do with yPLT in the future, please refer to this report.

Where can I buy yPLT to participate?

UniSwap:

With Love, PlutusSwap Team

11th October 2020

Marketing/PR Campaign & Airdrop

New Partnership

yPLT Utility

Dear PlutusSwap community,

Happy Sunday and what a week it has been for us and the community. On 7th October, yPLT is listed on UniSwap at 18:00 (GMT +8) and PlutusSwap is launched 4 hours later. Although everything went great during the launch, the idea of yPLT Devs holding pre-mined tokens caused FUD to spread on social channels. Despite the team burning ALL of the pre-mined yPLT two days later, the momentum within the community fell and yPLT token holders are concerned about the price of yPLT. We understand that our marketing plan and decision making has not proven effective over the past few days. It is definitely our very own responsibility to deliver all promised product and to create awareness for yPLT into the DeFi market. Although PlutusSwap is currently just a farm for users to earn yPLT incentives, this is not the final stage of PlutusSwap. As mentioned previously, the initial stage of PlutusSwap is to distribute yPLT to the early community before AMM launch, encouraging early engagement on PlutusSwap. yPLT genesis mining stage will end in upcoming days and 100yPLT/block will be reduced to 10yPLT/block during stage 1, stabilizing the emission rate to create a sustainable token ecosystem in the long run. Information on how yPLT can be utilised during the AMM launch will be explained in the latter part of this report.

Here are some of the new action plans and updates to our community-

1) Marketing/PR Campaign and yPLT distribution

As most of you are aware of, 95% of yPLT mined are distributed to users and 5% goes to the PlutusSwap Dev for future development. To incentivise our early community, as well as bringing in new community members, the team will be distributing back all yPLT mined during an upcoming airdrop campaign. Details will be announced early next week. We will also be pushing a couple of marketing/PR campaigns about yPLT before the AMM launch. yPLT might be down now but that will not stop the team's development or affect our commitment to build the promised product/ecosystem. We are not an experiment or testing the market. To our existing token holders, this is not the end of yPLT. This is just the beginning of something great to come. A huge shout out to our community for giving constructive feedback and messaging us to offer help. Our community managers have forwarded us your messages. Your love and support will not be let down. We understand that timing and marketing in DeFi are crucial. While working on development, we will also focus on marketing/community building. We are hiring marketing specialists as well as community managers! If you would like to partake on this journey with us, please send in your resume to hello@yplutus.finance.

2) Partnership with an upcoming farm

We have contacted a couple of projects regarding potential partnerships. As of today, we are pleased to announce that we have confirmed and finalised one partner to be integrated on PlutusSwap. As the project is still undergoing development for their upcoming DeFi protocol, detailed information will be disclosed once it is launched. However, that does not mean that we are partnering with a random and anonymous DeFi project that is new to the cryptocurrency industry. Our upcoming partner is an existing cryptocurrency project that has been around since 2018. They are an existing chat/e-commerce application that allows users to spend/buy/sell cryptocurrencies within the app and reward users who stake their tokens on their very own open-source wallet. Our partner has already launched their own mainnet this year and has successfully migrated from the Ethereum network to their proprietary blockchain. They boost a community of 100,000+ users and has various blockchain partners with their ecosystem. Their upcoming DeFi protocol will allow users to farm tokens and spend on their app. They will also be introducing "EMOJI" NFTs among other NFTs on their platform that allows users to trade and use, earn royalties from it. As per the partnership agreement, yPLT LPs will benefit from higher rewards/incentives on our partner's platform and we will be leverage on each other community. This partnership allows the Plutus Capital/PlutusSwap ecosystem to ride on a high volume industry such as chat/e-commerce applications. With a lending and chat application partnership in place, we are very much looking forward to every possible integration between these two different industries! Detailed partnership report will be announced in the upcoming weeks once our partner is really to launch. Of course, partnerships will not end here and we will be updating the community once another new partnership is confirmed!

3) What can yPLT be used for in the future?

PlutusSwap will eventually add an AMM system into the master contract. yPLT will be the governance token for PlutusSwap, allowing token holders to vote on proposals. We will also be integrating PlutusSwap into the existing Plutus Capital infrastructures. Instead of just farming for yPLT by staking UniSwap LP tokens, our users can swap for different ERC20 tokens and provide liquidity into different pools directly on PlutusSwap as well. As a liquidity provider on PlutusSwap, you will receive our very own LP tokens and earn trading fees for swaps that occurred on PlutusSwap. On top of that, users can earn extra incentives by staking these LP tokens and farm yPLT. As we have yet to finalise on the fee distribution allocation, we are open to hearing feedback from our community. Here are 3 possible options currently in our plan,

0.2% to LPs, 0.05% Buyback yPLT on PlutusSwap and Burn, 0.05% to yPLT holders.

0.25% to LPs, 0.05% BuyBack yPLT on PlutusSwap and Burn.

0.25% to LPs, 0.05% to yPLT holders.

Unlike other AMMs like SushiSwap, the plan to is add a deflationary element into yPLT once the AMM is launched. Trading fees follow the market standard of 0.30%.

Idea 1 is to add both deflationary element and incentives for yPLT token holders (think of it like dividend or profit-sharing of a traditional company). End goal: Mitigating the emission rate from yPLT liquidity mining while incentivising yPLT token holders directly by distributing a portion of the trading fees. However, LPs will receive 0.05% lesser share of trading fees in option 1.

For 2, although fees are not distributed to yPLT token holders directly, deflationary element exists. End goal: Reducing the supply of yPLT along the way while Liquidity Mining is happening. Users can still stake PlutusSwap LP tokens on PlutusSwap farm and receive yPLT in return, while the yPLT generated from LM will be countered (the impact will be based on trading volume) with tokens burnt from the yPLT buyback on PlutusSwap.

For 3, it’s pure incentives directed to LPs and yPLT token holders.

The final mechanism has yet to be confirmed and if you have any suggestions, do let us know. On-chain governance for PlutusSwap is not live yet but your voice is still extremely important! Community suggest and we will do our best to implement/#BUIDL. We will be updating our Github with the latest development of our upcoming AMM system. Once there's any new update, we will be sharing with the community. https://github.com/PlutusSwap/yplutus

We thank all of our community members for their support over the past week and we will continue to bring you the latest update and progress. We are not here just for a good time and we will not let you down.

With love, PlutusSwap team

9th October 2020

"100% Burnt, No Time-Lock. No pre-mined reserves" An open letter to the community regarding this decision.

Dear PlutusSwap Community,

If you've read yesterday's update (below), we mentioned that we will be burning 4,920,420 yPLT and sending 4,920,420 yPLT to a Time-locked contract for 30 days. However, many of our community members on Telegram and Discord commented that we should be burning all 9,840,840 yPLT on the main wallet instead. We heard our community and after much consideration, the team came to a conclusion: To BURN ALL of the 9,840,840 yPLT in our main wallet.

As of today, 9th Oct 2020, the team does not hold any pre-mined yPLT. Initial yPLT contributed for liquidity (36,600 yPLT) are locked for 1 year on UniCrypt.

Proof of Burn: https://etherscan.io/address/0xd0ea86f14e35984cc51cc470079039d00582a935#tokentxns

Firstly, we would like to explain why a Time-lock contract was initiated in the first place. As mentioned in previous articles/documents, the proposed Time-locked yPLT was supposed to be a community-governed fund whereby yPLT token holders get to decide on how we should allocate these tokens for future development and marketing purposes. Although PlutusSwap is currently just a farm for equitable distribution of yPLT to the community, we will be releasing our own AMM system in the future. However, in order to catch up with AMM pioneers such as UniSwap, Balancer and SushiSwap, PlutusSwap intended to allocate a sum of yPLT whereby the early community gets to decide on how PlutusSwap should incentivise more users to come onboard our ecosystem. However, we understand the community's concern regarding projects holding reserves. The existing DeFi space is corrupted with projects trying to dump their tokens on investors and abandon the project. It is sad to see how terms like "rugpull, scams and pump & dump" are becoming a norm within the DeFi community. Although blockchain, in general, is supposed to be a trustless system, relationship between the community and project is still built on trust. Therefore, we decided to take the first step and commenced a 100% token burn instead of sending the pre-mined yPLT to a Time-lock. The truth is, regardless of time-lock or not, PlutusSwap is here to stay. Why would we want to risk all of our Plutus Capital clients since 2019 and the US$6m+ locked up on the Plutus lending app?

The main goal for PlutusSwap is to integrate an AMM system into the existing Plutus Capital lending app. The purpose of yPLT at its current stage is to promote equitable distribution to early adopters before AMM launch. It allows Plutus Capital to tap into a wider market as well. Recently, one of our community members asked a good question on Discord - "How will the mission of decentralized banking be executed by a company from a country with a track record for authoritarian centralization?"

One of the amazing characteristics of Blockchain is that no regulatory body can interfere. Censorship resistance is key. One such example is Plutus Capital's clientele from China. China's regulatory bodies are known to be anti-cryptocurrency. However, despite the deterrence from the Chinese government, most of Plutus Capital users are from China. This is also why most of the Plutus Capital documents and infrastructures are adapted to Chinese users. Now with PlutusSwap, our ultimate goal is to tap into the worldwide #DeFi community!

You will probably be wondering now, if the team burn all pre-mined tokens, how can PlutusSwap development continue?

This is when liquidity mining comes into place. If you refer to our mining details, you will see that 95% of yPLT mined are rewarded to users on PlutusSwap and 5% goes to the development team. The team will only have access to this 5%. In other words, the team has to ensure the continuous growth of PlutusSwap.

For those of you who are wondering if PlutusSwap can mint any yPLT even after burn, the answer is NO. We've transferred ownership to the master contract and NO ONE can mint any yPLT tokens. New tokens supplied into the market will purely come from Liquidity Mining ONLY, according to the mining schedule. Speaking about mining, less than 80 hours till 100yPLT/Block reducing to 10yPLT/Block. Which means there will be lesser yPLT generated on PlutusSwap. If you wish to accumulate more yPLT from farming, it is best to do so before Stage 1 begins.

Mining will be divided into 5 stages: yPLT is mined every Ethereum block (around ~ 20 seconds a block) Below is the schedule of mining=> Genesis Mining: 100 yPLT/block,total 50,000 blocks(~7 days) Stage 1:10 yPLT/block,total 5,000,000 blocks(~1.9 years) Stage 2:5 yPLT/block,total 5,000,000 blocks(~1.9 years) Stage 3:2.5 yPLT/block,total 5,000,000 blocks(~1.9 years) Stage 4:1.25 yPLT/block,total 5,000,000 blocks(~1.9 years)

Thank you everyone for your support and let's look forward to greater things ahead!

With Love, PlutusSwap Team

8th October 2020

Dear PlutusSwap community,

It came to our attention over the past 12 hours that many users asked about inflated yPLT token supply and the value of yPLT.

For those of you who read our documents, you will probably notice a couple of key pointers and we would like to highlight on them.

Firstly, the perpetual increase in total supply is due to liquidity mining. This is the source of the $yPLT generated on PlutusSwap farms.

The total amount of yPLT is 100,000,000, which will be released in about 8 years through mining. 95% of yPLT released by mining is distributed to users and 5% is reserved for the development team. yPLT LP holders will also receive x10 rewards for supporting the ecosystem.

Mining will be divided into 5 stages: yPLT is mined every ethereum block (around ~ 20 seconds a block) Below is the schedule of mining=> Genesis Mining: 100 yPLT/block,total 50,000 blocks(~7 days) Stage 1:10 yPLT/block,total 5,000,000 blocks(~1.9 years) Stage 2:5 yPLT/block,total 5,000,000 blocks(~1.9 years) Stage 3:2.5 yPLT/block,total 5,000,000 blocks(~1.9 years) Stage 4:1.25 yPLT/block,total 5,000,000 blocks(~1.9 years)

The second commonly asked question is, if supply keeps increasing, the price will drop due to supply exceeding demand.

As mentioned in our document, "The goal of yPLT at its genesis mining stage is to achieve equitable distribution to the community before launching the updated smart contract with an improved AMM design." The existing function of PlutusSwap now is a "farm". However, we are working on an AMM system that can be implemented on the Plutus Capital existing lending app (as mentioned before launch). Which means, other than voting rights within the ecosystem, yPLT token holders will receive fee reward for swaps. Detailed tokenomics and structure will be released upon confirmation. Just so you know that PlutusSwap is not staying as a farm all the way. There's no point for us and the community to just maintain a farm and borrow liquidity from UniSwap forever. Farming is just the beginning for our early adopters to hold yPLT. We needed to borrow liquidity from UniSwap to ensure early distribution of yPLT.

Thirdly, if we are becoming an AMM in the future, why is governance/voting not included in existing smart contract yet. The TLDR answer is - Because too many existing projects' development was delayed at the voting stage, hindering deployment date. We need to ensure the health of our ecosystem at the initial stage, and there will be changes to the smart contract that require immediate attention and implementation. Such example is the burning of tokens and the concern of emission rate raised by our community members. We are currently working on how we can implement changes to ensure a healthy token supply.

The next question will be, WHEN will implementation of governance and integration with Plutus Capital be done? We are projecting a 30-day window (Hence the initiated 30 days Time-Lock contract) where we monitor yPLT emission and also community adoption. DO note that technical development is always ongoing. This does not just include PlutusSwap development but also the Plutus Cap Lending app. If yPLT ecosystem achieves stability even earlier, we will move much earlier.

Meanwhile, there are a couple of prioritised objectives from PlutusSwap developers today, on top of ongoing development.

- Burn half of the existing 9,840,840 yPLT and send the remaining half to Time-lock contract once it is done! Code is in progress.

Burn: 4,920,420 yPLT

Send to TL Contract: 4,920,420 yPLT

- Figure out and solve the issue of why yPLT/USDT APY is not reflected on site.

- Include direct links to yPLT UniSwap pairs on our site.

The team has submitted listing applications to CoinGecko as requested by the community, along with Defipluse, Defirate and Defiprime. The team thank everyone for your comments, feedback and support over the past few days (or hours). We will continue to bring you the latest update and progress. Do let us know if you have any other feedback and we will look into it!

With love,

PlutusSwap Team.

7th October 2020

yPLT listed on UniSwap at 18:00 (GMT +8) with yPLT/USDT and yPLT/ETH pairings.

Locked all liquidity on UniSwap for 1 year on UniCrypt

All 99 ETH collected from presale (2/10 - 6/10) contributed back to the UniSwap liquidity pool. 59,160 yPLT sold out during presale.

Burnt 63,400 yPLT

Last updated